|

Previous

Page - 10

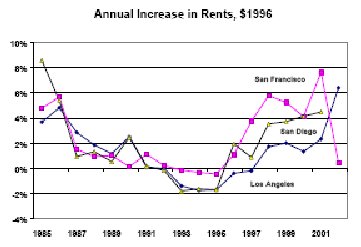

Bottom line: Bay area home buyers are placing a big bet on an early tech bounce back that will support rental increases similar to 1998 and 1999. Thatís a risky bet. I hope they are otherwise diversified.

There is no such thing as a housing shortage

Now letís get back to this shortage idea. There is no question that single family home starts have been weak in California during the 1990s as can be seen in the charts below. Multi-family starts have also been weak in the Southland but strong by historical standards in the North. So what, I ask? Thatís not a "shortage", at least not how I understand the term. A freely functioning market doesnít have shortages. A market system has high prices for some goods and services and low prices for others. A "shortage" is created when the price mechanism is not allowed to work. There can be a "shortage" of umbrellas in an LA rainstorm because sellers choose not to mark up the price to equilibrate supply and demand. Then the sellers run out of the goods, and you and I go without, even though we would have been willing to pay a handsome premium for an umbrella at just the right time. A shortage can portend a rise in price, if the basic supply and demand conditions that gave rise to the shortage persist, and if the market is allowed to equilibrate.

Next

* Edward E. Leamer,

Director, UCLA Anderson Forecast.

Check the link for author's profile: http://www.anderson.ucla.edu/faculty/edward.leamer/pdf_files/cv.pdf

|