|

Bubble Trouble? - by Edward E. Leamer * Page - 16

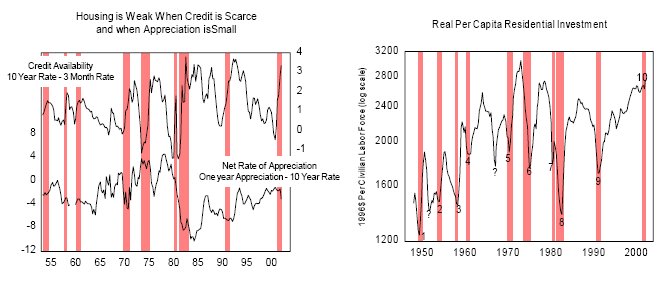

These two housing predictors can be combined into a single financial conditions index, with weights on the two components determined from the optimal combined predictor: 80% on the spread and 20% on the appreciation rate. After standardizing to have mean zero and standard deviation one, we have the index displayed below. This offers a highly favorable view of what lies ahead for housing. The value of this index in 2002 Q2 is 1.8, virtually as high as it has ever been, almost two standard deviations above its mean.

* Edward E. Leamer, |