|

Previous

Page - 2

These structural changes in the equity derivative market made it organized and transparent. The beginning of index futures trading on June 9, 2000 was perhaps the defining moment for the BSE in the context of equity derivatives The NSE began trading futures with the S&P CNX Nifty as the underlying, three days after the launch of Sensex futures, June 12, 2000.

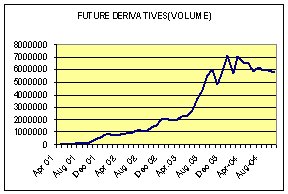

Initially, the creation of derivative market as standardized key to unbundling and managing risk in banking, investment, capital and insurance markets was opposed on various grounds by BSE broker-dealers who dominated the markets as principals for their own benefit (opaque badla), rather than acting as mere intermediaries between issuers of securities and ultimate investors. Subsequently, with participation from risk averse people in greater numbers, the trading volumes up-surged. Tata Mutual Fund became country's first fund for investments in the equity derivatives market to have a proper hedging mechanism. Lower risk, lower investments and higher returns made this segment popular with investors. The turnover in the derivatives market spurted by over 5 times during 2002. The derivatives market turnover touched a record high of nearly Rs. 40 bn, which was almost 75% of the cash market. This market was the beginning of a new era.

Next

* Contributed by -

Nidhi Sethi,

Batch of 2006,

IMT Ghaziabad.

|

|

|

|