|

Previous

Page - 6

The daily global volume in Commodity Trading touches 3 times of equity derivative market. With just a few months in action, ICICI Bank promoted NCDEX alone registers about 85000 to 100000 trades per day. The re-establishment of commodity derivatives was welcomed by arbitragers and hedgers. Even retail investors showed interest, as unlike equity futures, he could start with as low as Rs. 5000, and because of flexibility in contract sizes for different commodities, the ability to leverage was also much higher. MCX allows Indian shipping industry to hedge their freight rate risks. Daily volume of commodity trading of Rs. 2500 crores has surpassed 2000 crores turnover at the BSE. Commodity futures involve a large number of small participants. From January to May 2004, there were 237579 trades of value Rs. 3175 crores, giving an average transaction of Rs. 133640.

The problem is that this market lacks global standards and good supervision (regulated by FMC, which is under control of Ministry of Food and Agriculture).

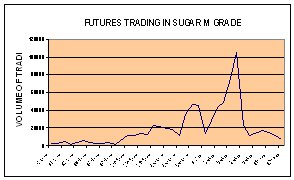

There exists a huge prospect in the commodity derivative market. It is now being extended to edible oils, oilseeds, oil cakes and sugar industry. Indian derivative market can capitalize on this opportunity by emphasizing upon an open and well distributed market with adequate spot price recovery and effective risk settlement to improve the Smaller and retail level participation.

Next

* Contributed by -

Nidhi Sethi,

Batch of 2006,

IMT Ghaziabad.

|