|

Previous

Part - III

Pillar II: Supervisory Review Process

The second pillar of the New Accord provides for supervisory review of bank's capital adequacy and internal risk measurement processes. National supervisors will be responsible for evaluating and ensuring that banks have sound internal processes in place which will enable them to take care of all existing and potential risks and capital adequacy requirements.

Pillar III: Market Discipline

With Pillar III, the BASEL Committee seeks to enable market participants to assess key information about a bank's risk profile and level of capitalization - thereby encouraging market discipline through increased disclosures. Pillar III is intended to act as a complement to the other two pillars. The focus of this white paper is Credit Risk aspects of BASEL II.

CREDIT RISK REQUIREMENTS FOR BASEL II IN BANKS

Credit Risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. The goal of credit risk management is to maximize a bank's risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. Banks need to manage the credit risk inherent in the entire portfolio as well as the risk in individual transactions.

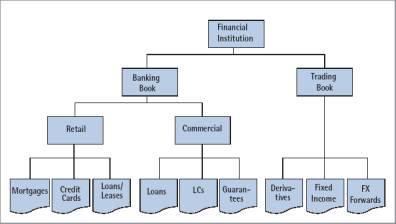

An enterprise view of the various sources of Credit Risk in a bank is represented below:

Next

* Contributed by -

Prashant Jadhav,

2nd Year PGeMBA (Finance),

Mumbai Educational Trust (MET) Schools of Management, Mumbai.

|