|

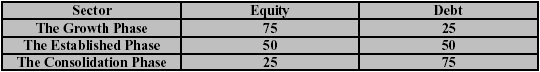

Investment Models in the Mutual Fund Industry - by Sarthak Kumar Rath * Part - VII Floating Rate Funds seeks to eliminate the interest rate risk by resetting the coupon rate regularly. An investor who enters a floating rate mutual fund will curtail volatility arising from interest rate risk to a considerable extent. However there is a downside to investing in an floating rate scheme .As the coupon rate gets reset depending on the interest rate scenario, the investor may loose out on a higher coupon rate, if there is a general decline in the interest rates. These funds are suitable for investors who are willing to sacrifice returns for the sake of higher safety and lower volatility. Fund of Funds is a mutual fund, which invests in the corpus of other mutual funds. Such mutual funds can invest in equity or debt schemes or both combined. Such concept is new in the Indian markets but has been around for years in the American and the European market. For instance Templeton has applied for three different mutual funds under this category with different proportions of debt and equity. (See Table 2)

Table 2: Franklin Templetonís proposed FOFs The main idea behind the Fund of Fund is diversification. If one fund doesnít perform the risk is reduced because there are a significant proportion of other funds that are performing. Besides, fund managers will undertake a systematic portfolio re-balancing to maximise gains and phase out non-performing funds. The FoF is aimed at retail investors as well as institutions. * Contributed by - |