|

Previous

Page - 3

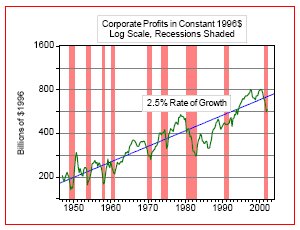

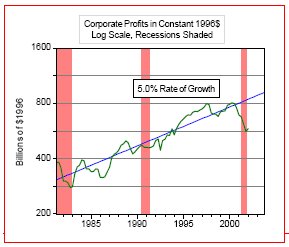

If your life as an investor didn't begin until 1980, you would see a very different picture - the one on the right, which suggests "normal" corporate earnings growth of 5%, not the 2.5% from the longer view. A much higher p/e ratio is easily justified with this kind of growth and the elevation of the S and P p/e ratio from 7.5 in 1982 to 24 in 1993 is fully supported by this "new" 5% growth in earnings. In this shorter view, with data only up to 1997, you would have seen earnings growth above trend from 1994 to 1997, and you might have come to think of this burst as a New Economy phenomenon, since you were reading so much about it in the financial press. You might have come to think of the "normal" growth of corporate earnings to be 7% or 10% or, when the New Economy really gets rolling, maybe 50%! Whooppee. Bid that p/e ratio up to 40.

Next

* Edward E. Leamer,

Director, UCLA Anderson Forecast.

Check the link for author's profile: http://www.anderson.ucla.edu/faculty/edward.leamer/pdf_files/cv.pdf

|

|

|

|