|

Previous

Page - 4

Although corporate earnings stalled out at $802b in 1997 Q3, the momentum of the New Economy story supported an 80% increase in the S and P 500 index from 824 in 1997 Q3 to 1475 in 2000 Q3. That's a bubble, unless these investors know something about future corporate earnings that is a complete mystery to me.

Fundamental valuation depends on the growth of earnings and the discount rate

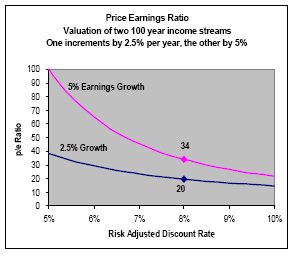

Now a brief primer on fundamental valuation. The present value of a stream of future corporate earnings depends on the rate of growth of earnings and also on the risk adjusted discount rate that is used to translate uncertain future earnings into today’s equivalent dollars. Below are p/e evaluation ratios for two different 100-year earnings streams. The higher value applies to the stream that has 5% earnings growth. The lower curve is the valuation of a stream with a 2.5% rate of growth. A p/e ratio of 20, such as the S and P had in the 60s applies to the 2.5% stream evaluated at an 8% rate of discount. At that same rate of discount, the 5% stream has a p/e ratio of 34, which is about what we had in the late 1990s. You can also get a 34 p/e ratio for the 2.5% stream if you use a lower rate of discount, about 5.5%.

Next

* Edward E. Leamer,

Director, UCLA Anderson Forecast.

Check the link for author's profile: http://www.anderson.ucla.edu/faculty/edward.leamer/pdf_files/cv.pdf

|